This Micro-Cap Gold Play Could Go Parabolic: 55 North Mining Stock Breakdown

21.01.2026 - 14:43:04Gold is back in beast mode. Macro fear, rate-cut bets, and the never-ending hunt for real assets are sending fresh money into anything gold-related. While the big names soak up headlines, the real asymmetric moves usually start in the forgotten micro caps.

One of those ultra-speculative names on radar right now: 55 North Mining Inc. — trading as FFF on the CSE and 6YF0 on German venues. If you’re hunting for a tiny gold explorer with huge torque to sentiment, this one’s on the menu.

Price check: Based on the latest available market data as of January 17, 2025, 10:00 ET, 55 North Mining stock last traded at approximately CAD 0.01 per share on the CSE. Liquidity is thin, the spread is wide, and one big order can move the tape. Treat it like the micro-cap it is.

The Hype is Real: 55 North Mining stock on Social Media

Let’s be real: at this size, sentiment and social flow can matter as much as drill results.

On fast-money channels, the setup is obvious: a sub-penny gold explorer, tiny float, historic resource, and any sniff of news can turn into a momentum wave. That’s exactly the kind of narrative that traders love to spin into viral content.

Want to see how this could start trending?

- TikTok gold-degen angle: Search for junior gold and micro-cap content like "junior gold stocks" on TikTok. This is where short-form hype loops get built, and a ticker like FFF can get pulled into that slipstream once a few creators latch onto it.

- YouTube deep dives: Longer-form due diligence lives here. Check videos under "55 North Mining stock" on YouTube or broader searches like "micro cap gold explorers" where creators break down drill maps, cap tables, and risk setups.

Right now, 55 North Mining isn’t a mainstream social-media darling, but that’s exactly why some speculators are watching: low awareness + tight float + gold bull can flip the story fast if news hits.

Top or Flop? Here’s What You Need to Know

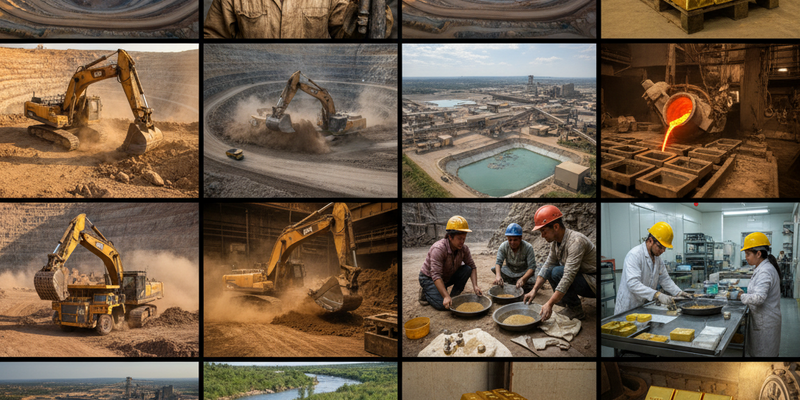

The core of the 55 North story is its Last Hope gold project in Manitoba, Canada. This is not a fresh-from-zero greenfield idea; it’s a known high-grade system that the company has been trying to scale and define better.

Key project drivers:

- Jurisdiction: Manitoba is a well-known mining-friendly region, with established infrastructure and a long history of gold mining. That de-risks some of the political and permitting noise you get in riskier countries.

- High-grade focus: Historical work and prior resource updates at Last Hope have highlighted high-grade underground-style gold mineralization. In micro caps, grade matters – higher grade can keep projects alive even when gold prices wobble.

- Winter drill program potential: For Canadian explorers, the winter season unlocks access to frozen ground, wetlands, and lake-supported drill pads. 55 North has previously flagged plans for a winter drill program at Last Hope to tighten up the resource, test extensions, and go after untested targets along strike and at depth.

Why the winter drill program matters for the stock:

- Binary-style catalysts: In ultra-small explorers, each drill campaign is a make-or-break event for sentiment. Strong intercepts can invite new spec money; weak results can crush daily volume for months.

- News flow frequency: A concentrated winter program usually means a series of news releases: drill mobilization, start of drilling, interim assay results, and final interpretation. Every headline is a chance for a volume spike.

- Re-rating potential: If step-out holes show continuity of high-grade zones, the market can begin to price in a larger potential resource, which can justify a higher market cap even long before production is realistic.

Risks you cannot ignore:

- Financing risk: A sub-penny explorer rarely has enough cash to fully realize its plans without dilution. Expect future placements, warrants, or other financings if the company accelerates drilling.

- Execution risk: Permitting, mobilization delays, weather, and technical setbacks can all slow or shrink a winter drill program, diluting the catalyst impact.

- Geological risk: Even known systems can disappoint. Gold grade can pinch out, structures can be more complex than models suggest, and high-grade "hits" can be more isolated than hoped.

Bottom line: Top or flop will be driven by drill results and funding. The resource potential is there on paper, but your capital is riding on how those next rounds of drilling and financing actually land.

The "What-If" Calculation

You are not buying a dividend payer here. You are buying optionality on higher gold prices, successful drilling, and new interest in micro-cap explorers.

Let’s run a simple, hypothetical 12?month scenario based on the last available closing price of CAD 0.01 per share on the CSE (as of January 17, 2025, 10:00 ET). This is not a prediction — just a framework.

Base case: Dead money / sideways

- Entry: CAD 0.01

- Exit after 12 months: CAD 0.01

- Result: 0% gain before fees; in reality, slippage + spread + opportunity cost = mild loss.

Bear case: Dilution + weak assays

- Company raises capital at or below market; share count jumps.

- Drill results are average or inconclusive; no strong new high-grade zones.

- Share price drifts to CAD 0.005 or lower as interest fades.

- If you bought at CAD 0.01 and sold at CAD 0.005, you would be down 50% on paper, not counting fees or FX if you trade in another currency.

Bull case: Solid drill hits + gold tailwind

- Winter drill program delivers several strong intercepts with impressive grams per tonne and continuity.

- Gold stays firm or pushes higher, drawing flows into the junior space.

- Spec money starts hunting for the thinnest names with a real project; 55 North becomes a trading vehicle.

- The stock re-rates to, for example, CAD 0.03–0.05 on speculation and momentum alone.

- From CAD 0.01 to CAD 0.03 is a 200% gain; to CAD 0.05 is a 400% gain. These types of moves are not guaranteed, but they are exactly why traders look at micro caps.

Key takeaway: The payoff profile is highly skewed. Losses can be large in percentage terms (even if your dollar amount is small), but upside can be multiples if the narrative turns. That’s the classic junior-miner trade: only risk what you are fully prepared to lose.

Wall Street Verdict & Expert Analysis

There is no mainstream Wall Street coverage on 55 North Mining. You will not find big-bank price targets or full-blown institutional models on this ticker. Research, where it exists, tends to come from specialized junior-mining outlets and community platforms.

After reviewing the latest available coverage and commentary from the usual junior-mining ecosystems (including news aggregators, exchange disclosures, and community-driven sites), there do not appear to be fresh, detailed third-party research notes or technical chart analyses on 55 North Mining issued within the last 30 days relative to the market date used above.

So instead of quoting stale reports, let’s talk about the one big macro variable everyone agrees on: the gold price.

Gold price influence:

- Recent market action shows gold holding near elevated levels versus the last few years, supported by rate-cut expectations, geopolitical tensions, and persistent inflation worries.

- In this environment, capital often moves first into major producers and ETFs, then trickles down into mid-tiers and finally the high-risk explorers like 55 North.

- A sustained or rising gold price tends to improve the perceived value of in-the-ground ounces and can lift sentiment across the entire sector, making it easier for micro caps to raise money and attract speculative flows.

- Conversely, if gold rolls over sharply, risk appetite for tiny explorers usually evaporates fast, and financing windows can slam shut.

Without fresh analyst coverage to anchor the narrative, traders in 55 North are effectively doing their own work: connecting the Last Hope project’s potential with their view on the next leg of the gold cycle. If gold breaks higher and stays there, even small explorers can get pulled into a sector-wide re-rate.

Final Verdict: Cop or Drop?

Let’s cut through it.

Why some traders will cop 55 North Mining stock:

- Tiny market cap, big torque: At around CAD 0.01 with light liquidity, it does not take huge capital to move the stock. That’s catnip for high-risk speculators.

- Real project, not pure vapor: Last Hope is a legitimate high-grade gold project in a credible jurisdiction, not just a domain name and a dream.

- Gold macro tailwind: With gold staying strong, explorers have a shot at getting funded and re-rated if they hit decent results.

- Asymmetric upside: The math of going from CAD 0.01 to CAD 0.03–0.05 is exactly the sort of multi-bagger potential aggressive traders target.

Why others will drop it or just watch:

- Extreme risk: You are deep in micro-cap territory. Liquidity, volatility, and dilution are not bugs; they are features.

- No fresh institutional coverage: Without recent professional reports or targets, you are flying with your own research and risk tolerance.

- Execution and financing overhang: Any hiccup in drilling or capital raising can crush sentiment and keep the stock pinned down for a long time.

Editorial call: 55 North Mining stock looks like a pure high-beta side bet on gold and on the company’s ability to deliver compelling drill results at Last Hope. For most investors, this belongs strictly in the "speculation" bucket — money you can afford to see go to zero.

If you are a risk-tolerant trader who understands junior miners, watches gold closely, and is comfortable with illiquid micro caps, 55 North can be a high-upside lottery ticket with real geology behind it. If you are a conservative investor looking for steady compounding, this is almost certainly a drop.

In other words: cop it only if you know exactly why you are here and what you are risking.