Franco-Nevada: Shares Rebound Amid Analyst Upgrades and Royalty Sector Momentum

19.12.2025 - 14:53:03Over the past three months, Franco-Nevada has mustered an impressive recovery in its share price, rising nearly 3% following a volatile period that saw both sharp dips and subsequent rebounds. In early October, the stock experienced significant pressure, largely tied to broader gold market volatility and concerns over global interest rates. Yet, as the year drew towards a close, renewed optimism around gold demand and a series of analyst upgrades propelled Franco-Nevada back into the spotlight. Is this just a pause in a much bigger rally, or does the momentum point to deeper structural strength?

See the dynamic Franco-Nevada chart and get the latest share price insights here

In December, news around Franco-Nevada heated up significantly. On December 10, shares rallied after RBC Capital Markets lifted its recommendation to "Outperform," citing improved sector prospects and a higher price target of $250 (previously $225). This upgrade came on the heels of UBS maintaining a robust "Buy" rating earlier in the month, nudging its own target to $270. These moves sparked notable bullish sentiment among investors, as reflected in a wave of renewed trading activity. The market's positive reaction was unmistakable, hinting at confidence in management's steady execution and underlying business model resilience.

Another December headline involved Franco-Nevada's role as a key investor in a CAD 32.5 million funding round for Osisko Metals. This strategic participation, alongside major mining names like Hudbay and Agnico Eagle, highlights Franco-Nevada's centrality in the royalty and streaming space, as well as its capacity to deploy capital on high-conviction goldmine projects. While the move didn’t cause immediate stock fireworks, some observers see it as a subtle but crucial signal—realigning capital into growth areas and fortifying the company’s pipeline of royalty income for the years ahead.

But not all was smooth sailing. Last month, the stock had to weather brief turbulence following tepid sector news and minor downward estimate revisions from a few covering banks. However, the overall analyst consensus remains staunchly positive, with a mean target that sits about 19% above the recent trading band—evidence that most expect further upside if gold prices stay firm or rise. The next key date for investors is mid-March, when Franco-Nevada is projected to announce its Q4 results; any surprises could swiftly reshape sentiment.

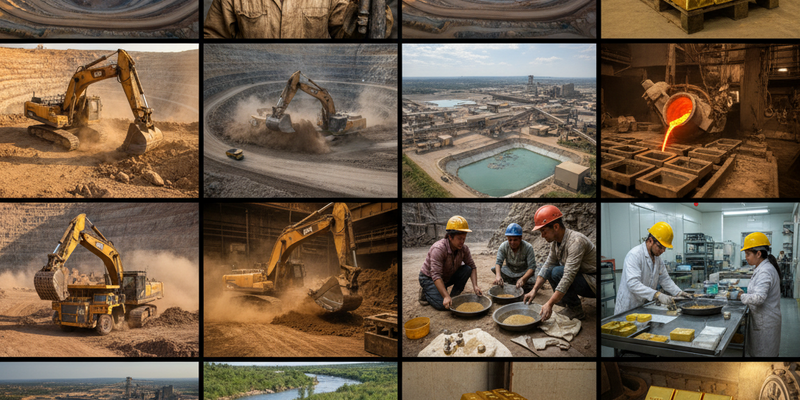

Diving deeper, Franco-Nevada’s underlying business model stands out as unusually robust within the mining universe. Unlike traditional operators, the corporation focuses on acquiring royalty and streaming agreements primarily on gold, but also on silver and platinum group metals. These arrangements give Franco-Nevada exposure to upside in commodity prices and new mine discoveries, but without the direct operational risks that beset typical miners. Its portfolio spans several continents, interlinking key assets in the Americas, Australia, Europe, and Africa. By targeting properties at all stages of development—from production to early exploration—the company insulates itself from the cyclical shocks that can batter single-mine entities.

Strategically, Franco-Nevada’s hands-off approach enables highly efficient scaling. The company consistently posts enviable margins and strong free cash flows, reflected in its sector-leading financial ratios. With an estimated yield around 0.7%, it also appeals to long-term, income-focused shareholders. The leadership team, headed by CEO Paul Brink, stays laser-focused on selective deal-making, often turning up early in promising jurisdictions or structures overlooked by more risk-averse players.

Still, the road is not without its pitfalls. The royalty and streaming model depends on the productivity and regulatory certainty of underlying mines. Any disruptions, be it from changing environmental regimes in Latin America or operational hiccups in partner mines, can ripple through future royalty income. Moreover, the accelerating global push towards ESG (environmental, social, and governance) standards adds a new layer of scrutiny, both for Franco-Nevada and its partners. Yet, as many analysts note, the corporation’s broad asset base, disciplined management, and balance sheet strength position it well to navigate risks.

Looking ahead, the outlook for Franco-Nevada appears cautiously optimistic. Supportive gold price trends, investor appetite for defensive assets, and the tailwind of favorable analyst sentiment create compelling conditions for the stock. The recent funding involvement with Osisko Metals hints at further deal activity, which could unlock value in 2026 and beyond. Some observers even whisper about transformative deals on the horizon, given Franco-Nevada’s capacity and network. Still, those considering a position would do well to monitor Q4 results and keep an eye on the evolving regulatory landscape across key mining jurisdictions.

In sum, while there are always risks in the mining universe—including price swings and policy unpredictability—Franco-Nevada’s unique blend of royalty-driven growth, sector leadership, and proven management makes its shares a perennial source of fascination for gold-focused investors. The coming months will be telling as to whether the latest surge is merely a blip, or the start of a golden era.

Track Franco-Nevada's live quote and price trends now – stay ahead of the next move