Bitcoin Depot Pursues Growth Through Acquisitions and Leadership Shift

02.02.2026 - 13:11:04

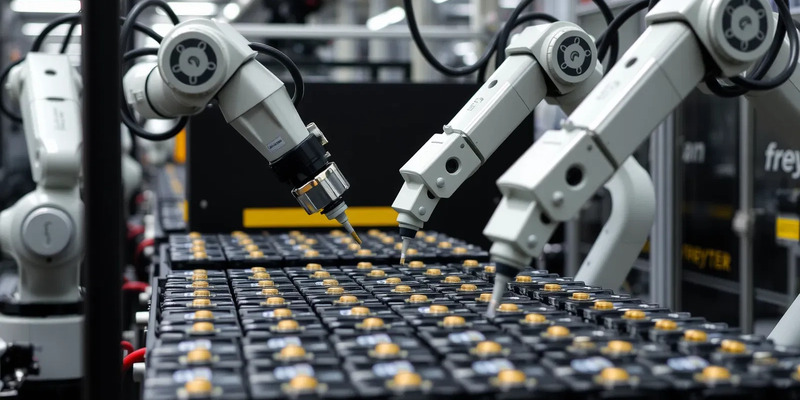

Bitcoin Depot has entered its 2026 fiscal year with a significant acquisition and a planned change in executive leadership. The company, a major operator of cryptocurrency ATMs, is strengthening its market position by acquiring regional competitors. This strategy raises questions about its potential to enhance profitability through industry consolidation.

A planned leadership transition took effect on January 1, 2026. Scott Buchanan, the former President and Chief Operating Officer, has assumed the role of Chief Executive Officer. Buchanan, instrumental in scaling the business model since 2019, is now tasked with guiding the next phase of global expansion and operational efficiency.

Founder Brandon Mintz has moved into the position of Executive Chairman. His focus will shift to long-term strategy and potential mergers and acquisitions. This transition is designed to ensure continuity while preserving the company's founding vision.

Strategic Acquisition Bolsters U.S. Footprint

In a move to consolidate its domestic market, Bitcoin Depot completed the acquisition of assets from Instant Coin Bank on January 13. This follows the company's 2025 integration of National Bitcoin ATM's kiosks, which substantially expanded its North American network.

Should investors sell immediately? Or is it worth buying Bitcoin Depot?

The strategy of absorbing smaller regional operators allows Bitcoin Depot to leverage its existing compliance and operational infrastructure across a larger device network. The goal is to achieve economies of scale, capitalizing on sustained demand for physical interfaces that convert cash to digital currencies—a key component of the fintech landscape.

International Expansion Gains Momentum

Alongside domestic consolidation, the company is actively pursuing international growth. Following a market entry into Hong Kong in late 2025, Bitcoin Depot is positioning itself among the leading providers in the Asia-Pacific region. The global market for Bitcoin ATMs continued a steady climb in 2025, reaching approximately 39,158 machines worldwide, with the United States remaining the core hub with over 30,000 units.

Investors are now awaiting detailed financial results. The report for the fourth quarter and full year 2025 is anticipated by the end of March 2026. Analysts from Zacks and Nasdaq expect this release to provide concrete data on the profitability impact of the recent acquisitions.

Ad

Bitcoin Depot Stock: Buy or Sell?! New Bitcoin Depot Analysis from February 2 delivers the answer:

The latest Bitcoin Depot figures speak for themselves: Urgent action needed for Bitcoin Depot investors. Is it worth buying or should you sell? Find out what to do now in the current free analysis from February 2.

Bitcoin Depot: Buy or sell? Read more here...