Agnico-Eagle Mines: Gold Rush Momentum and Volatile Shares Spark Investor Attention

29.12.2025 - 14:28:05Agnico-Eagle Mines has captured renewed attention from investors as its shares climbed approximately 8.7% over the last three months. The rally, marked by clear volatility, included a fast ascent on the back of soaring gold prices and several pivotal corporate moves. But as speculators wonder if this momentum is truly sustainable, the share’s recent rollercoaster poses a tantalizing question: Is this just a pause in a much bigger rally for Agnico-Eagle Mines in the ever-fluctuating world of gold corporations?

Follow the real-time Agnico-Eagle Mines share price, performance charts and latest news here

In just the past three months, Agnico-Eagle Mines shares moved from a challenging sideways consolidation zone to a pronounced upward trend, culminating in a year-to-date gain above 120%. The highest point in this period hovered near 249 CAD, with a brief retracement to around 222 CAD in late November before bouncing alongside gold hitting historic highs. This pattern reflects not only gold market euphoria, but also sector-specific moves: the entire gold mining and precious metals landscape has basked in renewed investor enthusiasm as precious metal prices shattered records.

Behind the numbers, news flow played a decisive role. In December, the company was in the headlines for both sector-wide and company-specific reasons. On December 22, mining stocks including Agnico-Eagle Mines accelerated as gold prices notched all-time highs, sparking a late-year sector rally. Earlier, on December 17, Agnico-Eagle Mines increased its stake in Osisko Metals via a private placement valued at C$12.5 million. This move, representing strategic expansion, was generally received as a signal that management sees ongoing opportunities in the gold and base metal space.

Interestingly, the news cycle was not entirely bullish. On December 10, RBC downgraded Agnico-Eagle Mines from 'Outperform' to 'Sector Perform', though the analyst simultaneously raised their price target to US$205 from US$185, highlighting mixed sentiment in the analyst community. Shares responded with a brief dip as institutional investors digested the report, but the magnitude of the reaction was tempered thanks to the supportive gold price backdrop. Meanwhile, the December 8 announcement of a Memorandum of Understanding with Nukik Corporation to advance the Kivalliq Hydro-Fibre Link further spotlighted Agnico-Eagle Mines’ commitment to sustainability and innovations in energy sourcing for its future projects in Canada’s far north—a move that could improve operating margins long-term.

Current market consensus, according to major financial platforms, still tilts towards a "Buy" on Agnico-Eagle Mines, with price targets reflecting optimism for further gold mine expansion and resilient corporation earnings. The shares float near performance highs at 247.68 CAD, with a modest forward dividend yield (below 1%), underlining Agnico-Eagle Mines’ capital returns strategy.

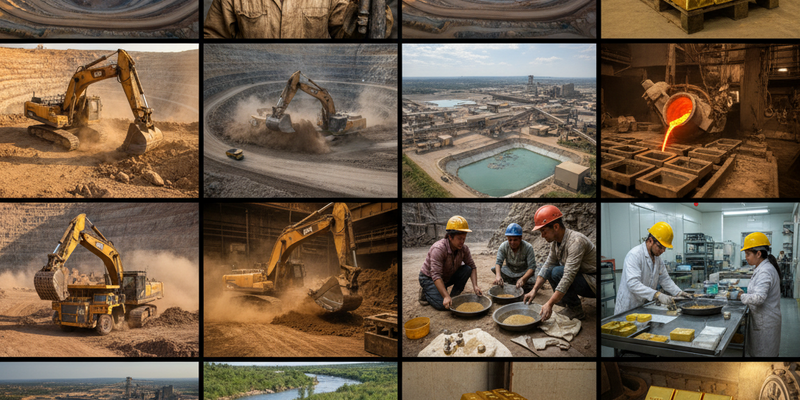

Stepping back, what powers the engine at Agnico-Eagle Mines? Headquartered in Canada, the company counts among the top North American gold producers, with significant mining operations in Canada, Australia, Finland, and Mexico. Its portfolio stretches from the Canadian Malartic Complex in Quebec to Detour Lake in Ontario, as well as global assets like Fosterville in Australia and Kittila in Finland. The business model emphasizes low-cost, high-grade gold deposits, scalable operational efficiencies, and ongoing exploration—its pipeline extends across several strategic projects, including the United States. In recent years, Agnico-Eagle Mines has bolstered its growth through both organic expansion and targeted acquisitions, with the December news around increased Osisko Metals ownership and the completed acquisition of the Fosterville tenement highlighting this ongoing approach.

Risk is an ever-present companion for any gold miner. Sector cyclicality, fluctuating gold spot prices, regulatory complexities, and inevitable project delays remain key investor concerns. The drive towards greener mining is reshaping cost curves and capex requirements, as seen with the Kivalliq Hydro-Fibre project. Yet on the positive side, Agnico-Eagle Mines enjoys a robust balance sheet, investment grade rating, and a management team praised for operational discipline—a combination that has won it a loyal fan base in institutional circles.

So, what next for one of the world’s leading gold corporations? Many observers see further upside if gold continues its bull run, especially as central banks and geopolitical risks keep safe-haven demand high. However, pending guidance updates and the outcome of several major exploration initiatives could drive further volatility in Agnico-Eagle Mines shares. For now, informed investors will want to track every step, from the impact of supply chain updates to potential new deals and capex plans—especially with sector momentum running so hot.

Track Agnico-Eagle Mines’ latest stock chart, earnings, and newsflow live